- search for the debtor first if there is any chance they may already exist. This will save time and frustration if you enter all demographic information on a debtor only to find out they already exist.

- search for the debtor first if there is any chance they may already exist. This will save time and frustration if you enter all demographic information on a debtor only to find out they already exist.

This option allows for the entry (addition) of new debtors, those that don't currently exist. The items that can be added for a debtor are:

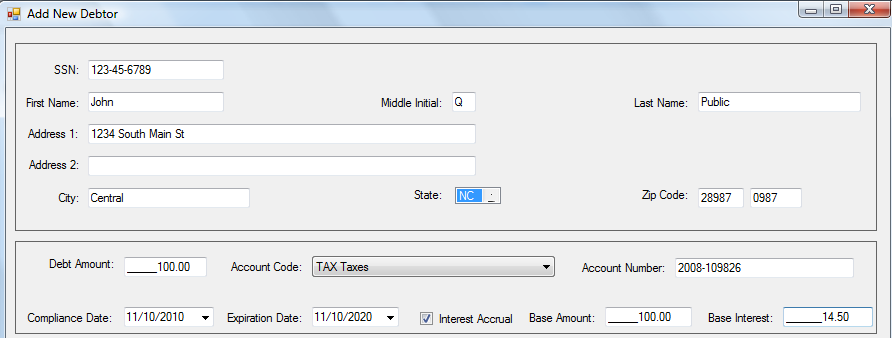

It also allows for a debt to be entered while entering the debtor. This is a great method to add a debtor and one debt. To add additional debts for a debtor, the Add Debt option is used.

* ITINs are for those persons not eligible for an SSN. However, their employers will put these ITIN numbers on their W-2 and 1099 forms. Don't assume a debtor without an SSN can't be setoff at the N.C. Department of Education or Education Lottery.

- search for the debtor first if there is any chance they may already exist. This will save time and frustration if you enter all demographic information on a debtor only to find out they already exist.

- search for the debtor first if there is any chance they may already exist. This will save time and frustration if you enter all demographic information on a debtor only to find out they already exist.

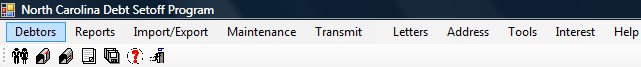

1. From the Main Menu click Debtors:

2.The Debtors menu option:

The Debtor menu option is also available on the Icon Toolbar: ![]()

- Add/edit Debtor Information

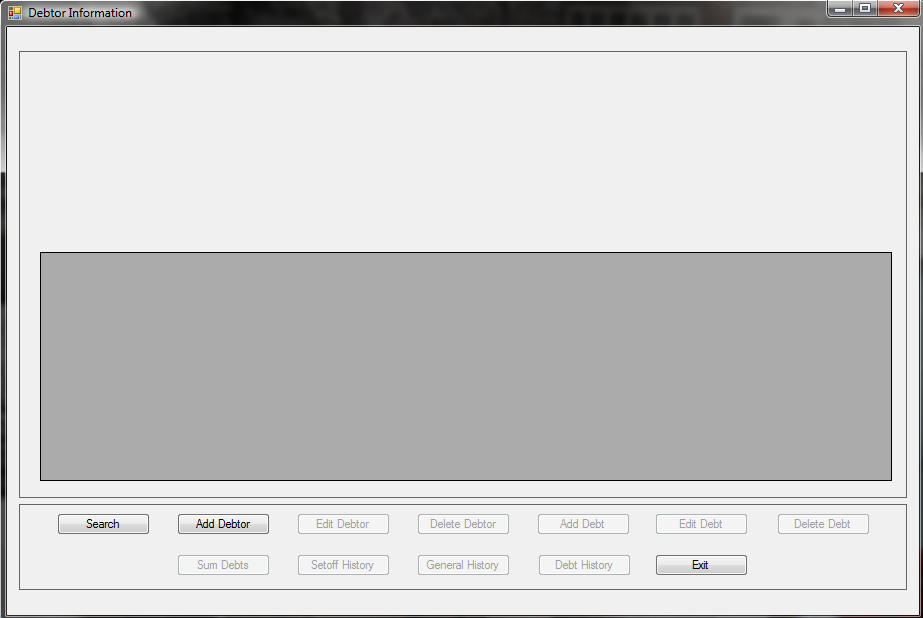

3. A blank entry screen appears:

4. Click ![]() for the following:

for the following:

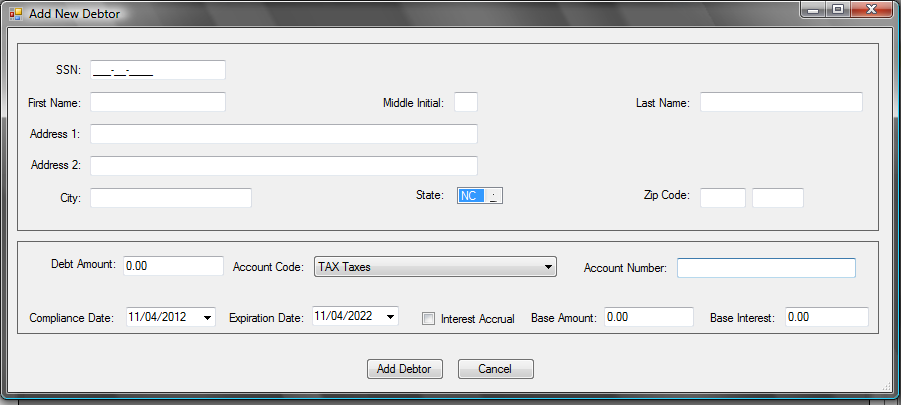

5. Enter the following demographic items, can be upper, lower or mixed case. If doing letters then the mixed case is recommended

Tip: Advance to the next item by pressing the Tab key or move the mouse and click

- SSN (Social Security Number or ITIN) [REQUIRED]

- [Must be nine digits]

- Cannot start with '000' or '999'

- ITIN - begins with '9' with range of 70-88 in the fourth and fifth digit, ex. 9XX-70-XXXX

- If you do not have an SSN for a debtor you can still enter a fake SSN (don't use a possibly real SSN, start it something such as 991-00-0001) so that the debt can be entered and a notification letter generated. Then once the SSN is acquired, then change it using the Tools-Users-Change SSN

- First Name [REQUIRED] [22 characters maximum] Can list both husband and wife first names

- Middle Initial [OPTIONAL] [1 character maximum]

- Last Name [REQUIRED] [25 characters maximum] Suffixes such as Jr., Sr., II, III, etc.

- Address 1 [OPTIONAL] [35 characters maximum]

- Address 2 [OPTIONAL] [35 characters maximum]

- City [OPTIONAL] [25 characters maximum]

- State [OPTIONAL] [2 characters maximum] To change to a state other than NC, click the first character of the state abbreviation then click the up or down arrow to the right of

To go back one state click the up arrow or to advance click the down arrow. Click the arrows to continue to go backward or forward until the desired state is displayed.

- Zip Code [OPTIONAL] [9 characters maximum]

- for Names - Department of Revenue will reject:

- if there is not a First Name AND Last Name, at least a First Initial

- if it is a Business or Corporation Name, even if putting part of the name in First Name and other part in Last Name

- if it says "Estate of"

6. Enter the Debt items:

- Debt Amount [REQUIRED] [Enter a decimal point and cents]

- Enter the amount of debt owed

- Do not add the $15 Clearinghouse fee, it will be added by the Clearinghouse before it is sent to the Department of Revenue or Education Lottery

- Enter the decimal point and cents

- Do not enter a dollar sign or comma

- Debt must be $50.00 or more to be submitted to the Department of Revenue and Education Lottery

- if a debt was originally $50.00 or more, but is partially setoff and the balance is now less than $50.00, it will still not be submitted for collection

- Maximum debt amount is $50,000.00 unless a lower amount is set in the System Settings

- Debts can be combined according to the combining debt rules:

- do not combine tax debts with any other type of debt: ex: a $40 tax debt and another $30 tax debt can be combined into one $70 debt

- debts over $50 should stand alone unless there is a debt less than $50.00 that needs to be combined with one over $50, ex: a $70 debt and a $60 would be two debts, not one combined $130 debt

- several debts under $50 can be combined to become more than $50, ex: one debt for $30, another for $20 and another for $15 could be combined into one $65 debt

- Note: if this debt is a tax debt and is interest accruing

- when entering the debt, make the debt amount the same as the Base Amount as the Debt Amount will automatically be updated to the total of Base Amount and Base Interest.

- if you enter the Debt Amount yourself as the total of Base Amount and Base Interest, then the Debt Amount will be in excess once the system combines them

- when entering an Interest Accruable debt amount make the Debt Amount AND Base Amount the same, key reminder: the two large numbers should be the same. The smaller number, Base Interest is different

- once a debt is added, the amount appears permanently as the Original Debt Amount and cannot be changed

- Account Code [REQUIRED]

- Click the

to view the possible list of Account Codes (if Account Codes were created in Tools-Account Codes)

the default account code is set in Tools-Users-System Settings. At the bottom right the User setting is what controls the default account code when Adding or Editing Debtors/Debts. Changing the User account code in the System Settings will NOT change it for all users. This is the one option in System Settings that is per User.

- An example of various Account Codes

- If Account Codes were not created, then leave

- Account Number [OPTIONAL] [25 character maximum]

- for local government use in tracking debts and determining the allocation of funds recovered for multiple departments

- If using Account Codes to designate departments, no need to put a departmental prefix such as "TAX-" or "EMS" but will not cause any problems if do this

- If combining debts it is suggested that:

- all account numbers be listed, separated by a "/"

- and a character or combination of characters to distinguish the combination of debts, such as "***"

- Compliance Date[REQUIRED] Format: month (two digit) "/" day (two digit) "/" and year (four digit), ex. 11/15/2012

- This is the "start" date of attempting to collect this debt. Called Compliance Date rather than Start because this is the date the local government is certifying that the debt is legally eligible to be submitted to the Department of Revenue and Education Lottery

- The Compliance Date must be at least 30 days beyond the date the required Notification letter was sent to this debtor

- The Compliance Date may be a date in the future, it is similar to post dating a check

- Once this Compliance Date passes it will be submitted to the Department of Revenue and Education Lottery

- Defaults to today's date. May be modified by typing over and entering a different date. If the date entered is more than 30 days from today a message will appear noting how many days in the future. An example:

- When entering a Compliance Date, to make a selection for a particular date, view the calendar, by clicking the

- The Compliance Report will print a list of debts that are not yet Compliant

- selecting a date which is a Friday means that the debt will be submitted to the Department of Revenue and Education Lottery the following Tuesday. When submitting near the end of the calendar year in an attempt to prepare for the upcoming tax year enter the date of the last Friday in December. This will assure that the debt is submitted the first Tuesday in January and before the N.C. Department of Revenue begins processing tax refunds.

- Expiration Date[REQUIRED] Format: month (two digit) "/" day (two digit) "/" and year (four digit), ex. 11/15/2022

- This is the "end" date for attempting to collect this debt

- The date must be a later date than the Compliance Date otherwise a message appears:

- Once this date is reached, it will no longer be submitted to the Department of Revenue or Education Lottery

- Defaults to today's date. But by clicking on the year, it then automatically changes to three years from the Compliance Date. But it may be modified by typing over to the desired date

- When entering an Expiration Date, to make a selection for a particular date, view the calendar, by clicking the

- There are statutes of limitations on the collection of debts. The Clearinghouse does not advise on how long a debt may be attempted to be collected. We suggest you discuss with your attorney. The minimum statute though is three years from the date the debt becomes delinquent for all debts except taxes. Taxes can be attempted for collection for ten years from the delinquency date. Note: the Clearinghouse does not monitor or adjust Expiration Dates. It is the responsibility of the local government to control their debt expiration dates

- The Expiration Report will print a list of debts that are already Expired

- if a local government has sent a notice/bill/invoice to the debtor within the past three years, regardless of how delinquent the debt is, this may classify the debt as active and may be submitted into the Debt Setoff program. Don't just assume that because a debt is older than three years(or ten years for taxes), that it cannot be submitted to Debt Setoff. Check with your management and possibly your attorney. The Clearinghouse can provide information from the N.C. Attorney General's Office regarding statutes of limitations for local governments.

- Interest Accrual[OPTIONAL]

- Used only for interest accrual on tax debts

- Non-tax debts that do not accrue interest would not be marked as Interest Accruable

- If the debt will accrue monthly interest , click the box

,so it appears as

- The original debt amount (principal) that is to be used to calculate a month's interest. You would not want to calculate interest on principal+interest as this would overcharge the debtor

- If the Interest Accrual box is checked, when the Monthly Interest Accrual option is executed, this Base Amount is what is used with the Interest Rate to calculate the month's interest amount

- Base Interest[OPTIONAL]

- The amount of fees and interest that has already accrued at the time the debt is added

- This allows for debts that are older and did not just recently become delinquent

Tip: editing an existing Interest Accruable debt

. If there is a need to edit the debt amount, for example, if the debtor made a partial payment, uncheck the Interest Accrual box, edit the Debt Amount to the correct amount, do NOT edit the Base Amount (it is still the original principal amount to be used to calculate the monthly interest) or Base Interest . Save the change, then edit and click the Interest Accrual box to set it back to Interest Accrual.

- Base Amount[OPTIONAL]

- The original delinquent debt amount (principal) that is to be used in the monthly calculation of interest. You would not want to calculate interest on principal + interest. That would overcharge the debtor.

- A sample Add Debtor screen:

Options:

- aborts without saving the debtor information

- aborts without saving the debtor information

to return to the Main Menu:

to return to the Main Menu: